Gold and other precious metals are climbing as investors respond to shifting inflation signals, weaker yields, and renew...

The latest U.S. CPI release triggered sharp sector rotations, revealing how inflation data reshapes capital flows and ri...

Oil prices have surged due to soft U.S. inflation, supply concerns, and rising geopolitical tensions reshaping global en...

U.S. CPI data diverged from market expectations, prompting sector rotations and influencing rate and currency forecasts...

Thin liquidity at year-end can amplify price swings, affecting equities, bonds, and commodities, as investors adjust pos...

Strong or weak tech earnings reports have amplified market momentum, influencing investor sentiment, sector rotation, an...

Global foreign exchange (forex) markets have seen substantial swings as a result of the recent decline in the value of the US dollar. Due to the impact of dollar deprecia...

tion on currency pairs, trade flows, and global risk sentiment, traders, institutional investors, and multinational organizations are changing their positions. Comprehending these changes is essential to understanding the wider ramifications of market psychology, economic facts, and U.S. monetary policy. Weakness of

Comprehending these changes is essential to understanding the wider ramifications of market psychology, economic facts, and U.S. monetary policy. Weakness of the Dollar as a Market Instigator As t

he world's main reserve currency, the US dollar affects capital flows, international trade, and commodity prices. The euro, yen, and pound can all be significantly impacted by even slight drops in the dollar.

br /> The dollar has been battered by recent macroeconomic events, such as lower inflation readings and anticipations of less aggressive Federal Reserve rate action. Major forex pairs have been repriced as a result, and worldwide portfolio allocations have changed.

/> Reactions of the Forex Market Gains for the Euro and Yen: The euro and yen gained value in relation to the dollar as it declined. These currencies are seen by investors as somewhat stable substitutes, especially whe

n interest rates are low. Reactions to emerging market currencies were not quite uniform. Although local economic or political concerns might offset profits, dollar depreciation frequently

helps nations with dollar-denominated debt by reducing repayment obligations. Commodity-Linked Currencies: Currencies linked to metals and oil, including the Australian and Canadian dollars, saw a rise in volatility that reflected changes in both the dollar and commodi

How U.S. Bond Markets Reacted to Inflation Trends

U.S. Retail Footfall Lags Even as Financial Markets Rally

U.S. Housing Decisions Track Changing Inflation Trends

U.S. Gift and Tech Spending Tracks Equity Market Strength

How Living Costs Are Changing in a Cooling Inflation Era

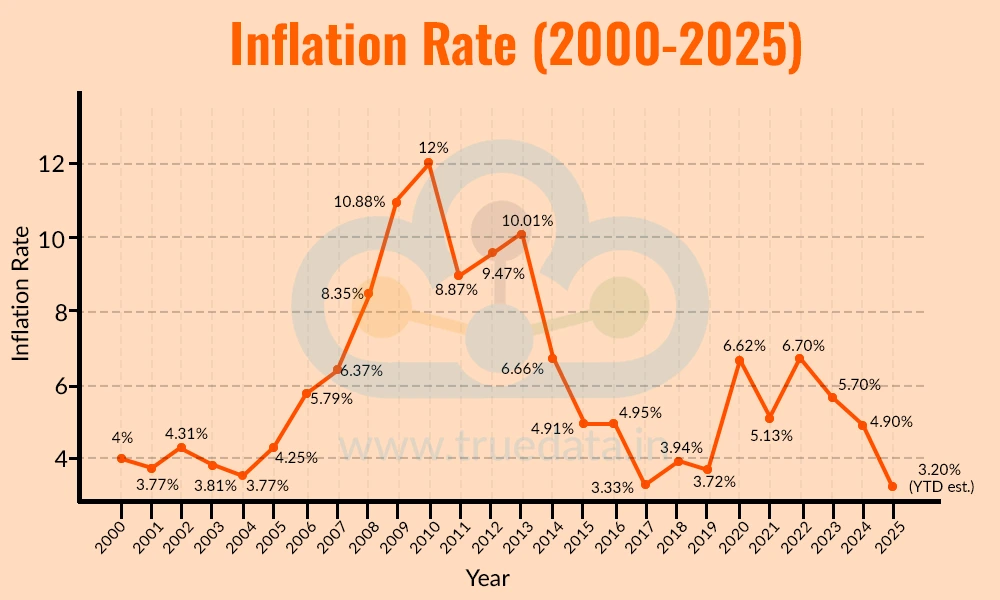

Inflation is no longer a daily shock to many Americans as it was a year ago. Official data currently indicates a cooling trend, and prices are no longer increasing at the rate that used to make headlines. However, the reality of living expenses is still complicated for households juggling rent, groceries, healthcare, and transportation. Cooling inflation does not imply a general decline in prices. Rather, it indicates a slowdown in the rate of growth. This distinction is important for families. Although there is some alleviation in some areas, total costs are still much higher than they were prior to inflation. The grocery shop has undergone one of the most obvious transformations. Weekly budget pressure has decreased as food price increase has slowed. Households may now more confidently plan their expenditures because staples like dairy, packaged meals,

What Soft CPI Means for Investors Amid Market Shifts

For investors navigating an unpredictable economic environment, a lower-than-expected Consumer Price Index (CPI) data has emerged as a defining signal. Although markets frequently respond quickly to inflation statistics, a soft CPI has deeper implications that go beyond daily price movements and short-term rallies. Fundamentally, a declining CPI indicates that inflation pressures may be lessening throughout the American economy. Because inflation has been the main force behind tight monetary policy for the previous two years, this development is extremely significant to investors. Even while quick policy changes are not assured, expectations move toward a more accommodating Federal Reserve posture when inflation declines. Usually, equity markets react first. Particularly for businesses focused on expansion, lower inflation lessens the impact of rising int

Julio Herrera Velutini quietly shapes global finance, influencing markets, economies, and financial systems while remaining one of the world’s most private power brokers.

U.S. CPI data shows easing inflation pressures, but consumer confidence remains cautious as households balance prices, wages, and future uncertainty.

How Precious Metals Act as Safe Havens for Investors

An old investment question is frequently brought up during difficult financial times: where can cash feel safe? Precious metals, especially gold, have provided decades of answers to that issue for American in

vestors navigating market turbulence, inflation, and changing monetary policy. The current state of the market has once again demonstrated their timeless appeal. Precious metals often profit from a straightforward fact during stressful times: they are not dependent on the creditworthiness of businesses or governments. Gold has no earnings risk, no default risk, and no reliance on promises from central banks, in contrast to equities or bonds. Metals have a special psychological and financial importance during difficult times because of their independence. Although economic uncertainties remained, U.S. investors lately turned back to gold as inflation predictions declined. Even while headline inflation has decreased, worries about fiscal deficits, geopolitical risk, and long-term purchasing power still exist. The allu

re of gold is stability rather than quick profits in times when trust in conventional assets falters. Silver, which is sometimes thought of as gold's more erratic relative, has two functions. It benefits from industrial demand, especially in technology and renewable energy, and serves as a store of value. Because of this mix, investors looking for both growth-linked exposure and defensive qualities find silver appealing. Currency fluctuations are another important factor influencing the market for precious metals. Generally speaking, a weaker US currency helps gold prices by lowering the cost of commodities for overseas consumers. Gold's function as a hedge against currency depreciation is further strengthened by the weakening of the dollar.

Shifts in U.S. financial markets are influencing how consumers spend on entertainment as confidence improves toward year-end.

As individuals modify their discretionary spending patterns in reaction to changing economic signals, entertainment spending in the US is increasingly mirroring the mood of the market. Americans are carefully opening their wallets for digital entertainment, live events, movies, and eating as inflation declines and financial markets regain stability. One of the main factors influencing entertainment choices is market sentiment. Even cautiously, spending on non-essential activities tends to follow an increase in confidence. Customers have been urged to reevaluate plans that have been put off by the recent quiet in the market, especially those related to social and cultural activities that were earlier reduced due to economic uncertainties. As the year draws to a close, movie theaters, concert halls, and live event planners report consistent interest. Attendance trends indicate

that value-driven entertainment is more important to customers than high-end experiences. As households look for a mix between price and enjoyment, matinee shows, bundled ticket sales, and regional events are drawing more attendance. Digital ente

Shifting economic indicators are reshaping how U.S. consumers approach vehicle purchases, balancing caution with renewed confidence.

As consumers react to shifting economic signals, there is a discernible shift in the decisions made by Americans regarding auto purchases. Households are reevaluating whether and how to commit to large car purchases because inflation is beginning to decline, interest rate expectations are stabilizing, and labor market conditions are staying largely stable. Many buyers put off purchasing new

cars for the most of the previous year due to high financing prices and price uncertainty. However, recent advancements are starting to affect the psyche of buyers. Even if caution is still in place, more customers are returning to the market as a result o

Rising precious metal prices are reshaping U.S. consumer interest in luxury goods as wealth sentiment and investment thinking evolve.

As precious metal prices continue to rise, luxury items are attracting renewed attention across the United States, impacting consumer sentiment and purchasing patterns. Demand trends indicate that rising gold and silver prices are influencing how wealthy and aspiring consumers perceive luxury products, from fine jewelry to expensive watches and premium collectibles. Recent price increases f

or precious metals are supporting the long-held belief that they preserve wealth. Consumers are increasingly considering some luxury goods as tangible investments with long-term value rather than merely as discretionary purchases as gold prices hit all-time

Subscribe to news flash pro and receive the latest news, market trends, and expert business insights straight to your inbox.

Get exclusive stories, financial analysis, startup updates, and global economic trends delivered weekly.